Amer IPO Risks Unpacked

A Following the Yuan X Calling the Shots collab. Primer on Amer+Anta, why we think the IPO is happening now and the risk factors.

Today, Anta-owned sporting goods company Amer Sports (NYSE: AS) is officially listed in the U.S. in an initial public offering of around US$1.37 billion.

Despite a discount, it is considered the largest IPO since last October, and it marked a rare occurrence of Chinese owners in the U.S. capital markets following Beijing's tech crackdown in late 2020.

I had the pleasure of looking at the Amer IPO with Yaling Jiang from Following the Yuan. You can read the full piece below.

Why IPO now at a discount? Two words: China and Arc'teryx.

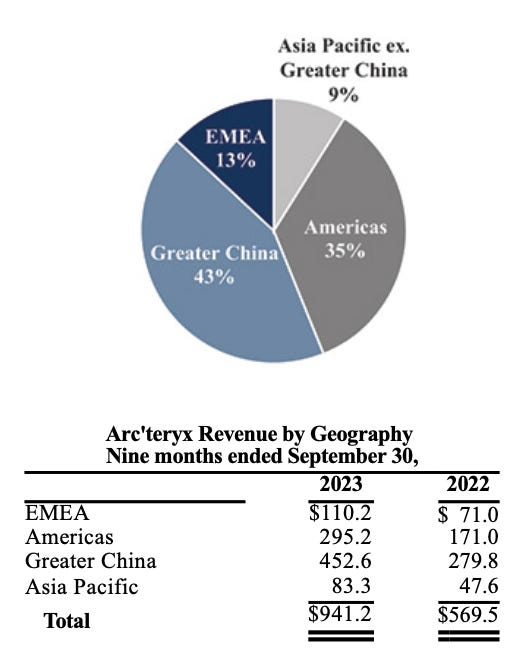

The factors driving Amer Sports' IPO are its rapidly growing revenue contribution from the Greater China region—particularly from the Arc'teryx brand. In 2022, the Greater China region was 14.8% of Amer's total income, up from 8.3% in 2020, to US$523.8 million.

In the first three quarters of 2023, China makes up around 20% of Amer's total income. Notably, Arc'teryx's revenue from China was a significant contributor and represents nearly 80% of Amer's total revenue from Greater China and more than 40% of Arc'teryx's global revenue.

Since Amer Sports was acquired by Anta in 2019, the potential for an IPO of Amer Sports under Anta has been much anticipated. Despite operating at a loss, Amer is crucial to Anta's global strategy.

A primer of Amer Sports and Anta

Amer Sports, a Finnish company, came under the ownership of a consortium five years ago. That group of investors includes Chinese tech giant Tencent, Hong Kong-based private equity firm FountainVest Partners, and Anamered Investments Inc., which is linked to Lululemon founder Chip Wilson. There are other members of the consortium, that for certain reasons, prefer to stay behind the curtain.

Known as a homegrown footwear giant founded in 1991, Anta’s global ambitions are evident in its robust M&A activities since 2009. It started with the acquisition of South Korean athleisure brand Fila and its operation rights in China. This move marked the beginning of Anta's journey to reshape its brand portfolio and global presence.

Its M&A spree continued, and in 2015, Anta acquired the British sports leisure brand Sprandi. In 2016, Anta acquired exclusive rights for the operation, product design, sales, and distribution of Japanese ski wear Descente in China. 2017 Anta continued its expansion by acquiring Korean outdoor brand Kolon Sport. The M&A activities culminated in the $5.2B deal in 2019 to acquire Amer Sports. Anta is now Amer's largest shareholder, holding a 52.7% stake.

Amer's IPO, why now? What discount?

Yaling: Now is a good time, because brand visibility and sales volume in China are still at high levels for Amer’s core brand Arc'teryx. But investors don't seem to think it’s enough to outweigh the China-related uncertainties, which seems odd to me.

In early January, Arc'teryx’s “Year of the Dragon Limited Edition” jacket was so popular that the price was inflated from 8,200 yuan to around 12,000 yuan on second-hand trading platforms. While it was common before Covid to see the prices of sneakers being hyped up, is rare to hear news like this in an economic downturn, which reflect a certain audience’s buying power.

Truth be told, some consumers are realizing that they are buying performance clothing simply to follow the crowd and it ends up as gorpcore-style fashion items. I think that’s ok too, like how athleisure has led mainstream fashion since over 10 years ago, gorpcore is not going anywhere.

Another truth be told, the mounting debt situation is worrying. Its IPO prospectus shows that with cash and cash equivalents of ~US$284 million, it’s carrying a whopping US$8.1 billion debt of all sorts.

It’s reasonable if the IPO was discounted — from the marketed US$16~18/share to US$13/share — because of the above reasons. However, investors seem to be more fazed by ‘over reliance on China’. I don’t understand.

Ivy: Amer is currently not consolidated into Anta's balance sheet. Therefore, the total value of Amer's portfolio of brands is not fully reflected in Anta's financial statements.

There are good reasons why it's not. Anta can maintain financial flexibility and avoid direct assumption of Amer's debt, and manage Amer as a separate entity based on its specific market needs. This setup also shields Anta's core financial structure from any potential risks associated with Amer. All of it means the Amer IPO can unlock value for its largest shareholder Anta.

3 reasons why investors should be careful – Ivy

Governance Conflict of Interests

The integration of Anta and Amer's executive teams poses a potential governance issue. James Zheng, who previously held a key executive role at Anta, now leads Amer Sports as its board Executive Director and CEO. In its F-1 filing, Amer Sports disclosed that its directors will continue their roles as officers of Anta Sports post-offering. Furthermore, as long as Anta owns at least 30% of Amer's ordinary shares, it can nominate five candidates for Amer's board, and in turn, can call the shots at Amer.

Scrutiny on Supply Chain and Sourcing

About one-third of Amer Sports' production value comes from China, where overlaps in facilities and labor practices create issues. Both Anta and Amer have faced criticism for using Xinjiang cotton. Amer's dependence on Anta’s third-party manufacturers and suppliers complicates the process for verification of component origins. This connection to Anta's supply chain could potentially damage the reputation and premium brand positioning of Amer and its portfolio brands. In the best case, adhering to Amer’s own standards will lead to a higher cost of goods sold, adversely impacting Amer's bottom line.

Competing Priorities Between Anta and Amer's Reputation In Light of the Xinjiang Cotton Issue

There will be instances where Anta and Amer must make tough decisions, sometimes in contradiction. During the 2021 Xinjiang Cotton Crisis, Anta was among the first to openly support Xinjiang Cotton and withdrew from the Better Cotton Initiative—a Geneva-based non-profit that promotes higher standards in cotton farming and prohibits Xinjiang cotton. Meanwhile, Amer remains a BCI member, committed to its policies that align with international human rights and ethical standards. Amer's hesitation to align its values and policies with its controlling shareholder, Anta, illustrates the difficulties Chinese companies encounter in managing their acquisitions. Both parent and subsidiary must navigate their distinct communication strategies and brand reputations to cater to their target consumer groups, especially Amer, which must be careful not to alienate 80% of its revenue source from outside China.

3 reasons why investors should not worry so much – Yaling

Amer Sports Is Safe(r) From Scrutinisation

Amer’s IPO comes at a time when Shein’s IPO faces delays in the SEC process. However, I don’t think Anta will face as much scrutiny as the likes of e-commerce sites Shein and Temu, and social platform TikTok.

According to an issue brief by the United States–China Economic and Security Review Commission, last April, “data risks…exploitation of trade loopholes; concerns about production processes, sourcing relationships, product safety, and use of forced labor; and violations of intellectual property rights” should be the top concerns for the U.S government. Amer seems to have little to worry about on these fronts.

Amer, Or At Least Arc’teryx, Has Generated Real Buzz

There have been cases (pre China’s tech crackdown) where Chinese companies made up narratives that did not reflect the true sentiments, like how the now-flopped luxury e-tailer Secoo (Nasdaq: SECO) said it was a market leader in China, and people bought it.

Now, this one company that’s been seen by Chinese consumers as the bright spot in this economic slowdown, is trying its chances. It deserves to be taken seriously although being Chinese-owned.

Anta’s Bet On Outdoor Sports Is Ahead Of The Curve, And The Sector Has Not Stopped Growing

It is not the first Chinese fashion company that owned foreign brands, but by far, it’s the most successful one in terms of reputation. Anta has successfully aligned its strategy with Beijing’s support for sports and fitness, as well as the interests of a growing number of consumers who’s keen to have an active lifestyle outdoors.

Similar to my views on pets, I believe that sports could be a sector that is relatively safe from crackdown and economic impacts.

With the 12th and 13th Five-Year Plans, which is a series of social and economic development initiatives issued by the central government every 5 years, the market added 1 trillion yuan of value to 2.9 trillion yuan in 2019 compared with 2016. The cabinet-level State Council now has a new target: By 2025, China’s sports market is to reach 5 trillion yuan, according to National Fitness Plan (2021-2025) that was issued in July 2021.

Last words from Ivy and Yaling: The Dream of Amer's IPO Amer Sports not only benefits from Anta's support but also carries the potential to elevate Anta's global stature. The acquisition of Amer was a strategic move for Anta, bringing renowned global brands under its umbrella and strengthening its international presence.

However, while Anta can boost these brands in China, can Amer reciprocate this success on a global scale for Anta? 🔚

What do we do 👩💻:

Yaling Jiang, the founder of research and strategy consultancy ApertureChina. She specializes in research, insights and strategies for overseas brands and financial institutions on the Chinese consumer market.

Ivy Yang, the founder of Wavelet Strategy, specializes in thought leadership and strategic PR consulting for Chinese companies in the global marketplace.